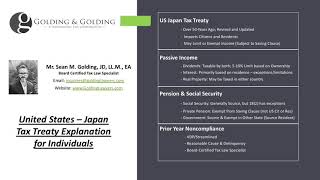

us japan tax treaty technical explanation

This is a technical explanation of the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income signed at Washington on. The US Japan tax treaty eliminates withholding tax on interest paid to a US lender.

This is based on the treatys statement that US reserves right to tax citizens regardless of treaty provisions.

. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law. In other words those pension vehicles are able to benefit from the tax exemptions for pension funds contained in. Technical Explanation of 2nd Protocol Amending Convention US and Japan Taxes on Income Oct 29 2015.

Department of the Treasury Technical Explanation of the most recent 2007 protocol amendments to the USCanada tax treaty. Article 11 provides that in cases involving a special relationship between the payor and the beneficial owner where the amount of interest paid exceeds the amount that would otherwise have been agreed upon in the absence of the special relationship then the treaty rate applies only to the last-mentioned amount that is the arms length interest payment as it is referred to. Non-resident taxpayers are not entitled to take foreign tax credits on their Japan income tax returns unless one has a PE.

Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where foreign-source income is taxed in Japan. Technical Explanation PDF - 2003. Source it is considered FDAP and tax is generally withheld at 30.

Under the Japan-US tax treaty if a resident of a Contracting State transfers any of the following assets the taxing rights on capital gains from such transfers are granted to the other Contracting State. ON NOVEMBER 6 2003. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long- awaited changes entered into force on August 30 2019 upon the exchange of instruments of ratification between the Government of Japan and the Government of the United States of America.

My US taxes should be the same whether I retire in the US or Japan. Some countries have estate tax treaties with the United States including Japan. Treatment of pass through entities.

The treatys saving clause is found in Article XXIX Miscellaneous Rules. Technical Explanation PDF - 1971. Technical explanation of the united states-japan income tax convention general effective date under article 28.

If there is a treaty in place the 30 may be reduced to 15 10 5 or 0. TAXES ON INCOME AND ON CAPITAL GAINS SIGNED AT WASHINGTON. 104 rows In the table below you can access the text of many US income tax treaties protocols notes and the accompanying Treasury Department tax treaty technical explanations as they become publicly available.

Tax Treaty January 31 2013 Similarly the Protocol expands Japans taxation rights in respect of real property situated in Japan. An Income Tax Treaty like the income tax treaty between Japan and the United States is designed to. Taxation describes the proposed income tax treaty between the United States and Japan as supplemented by a protocol the pro-posed protocol and an exchange of diplomatic notes the notes.

Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF. Real property situated in the other Contracting State. Foreign tax relief.

Key provisions include 1 zero rate with-holding on certain inter-corporate dividends on all royalties and on cer-tain interest including interest derived by banks insurance companies and other financial institutions. International Agreements US Tax Treaties between the United States and foreign countries have existed for many years and the US Japan Tax Treaty is no different. DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION OF THE PROTOCOL SIGNED AT WASHINGTON ON JANUARY 14 2013 AMENDING THE CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED STATES OF AMERICA AND THE GOVERNMENT OF JAPAN FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH.

These treaties may change the default taxation rules that the United States or another country would apply to people who file tax returns in that country. Amended Japan-US Tax Treaty. For example if a non-US.

Under the Protocol Japan is permitted to tax US. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Protocol PDF - 2003.

Person receives dividends from a US. The US Japan tax treaty provides explicit rules to decide whether treaty benefits are available to an entity or its owners generally depending on eachs country of residence and which entity or owner has liability for taxes on the entitys income. Ary 24 2004 Technical Explanation the Technical Explanation is the official guide to the new Treaty.

The Protocol also amends the provisions of the existing treaty that govern the taxation of gains from the disposition of real property located in a Contacting State by a resident of the other Contracting State by defining what constitutes real property situated in the other Contracting State for purposes of Paragraph 1 of Article 13 of the existing treaty. Perhaps the best source for this assertion is the US Treasurys Technical Explanation of the Treaty PDF which expressly clarifies that traditional IRAs Roth IRAs and 401k plans among other things are taxable pension funds for the purposes of the treaty. Unless otherwise specified the proposed treaty.

Film royalties are taxed at 15. The proposed treaty proposed protocol and notes were signed on November 6 2003. This article also refers to the authoritative US.

Estate tax treaty does change some of these rules so. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. A Except to the extent provided in paragraph 3 this Convention shall not affect the.

Residents on capital gains arising from the sale of shares of a company holding real property situated in Japan. A foreign person who is not considered a US. 1 january 1973 CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED STATES OF AMERICA AND THE GOVERNMENT OF JAPAN FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES.

Person may be able to avoid tax or pay reduced tax on US source income. Income Tax Treaty PDF- 2003. We have set out in this newsletter the timing of application of the.

Japan should consider my 401 k and my US private pension as retirement income for taxation purposes. Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7 months from the signature to the enactment due to additional time necessary for US ratification procedures.

Administering The Value Added Tax On Imported Digital Services And Low Value Imported Goods In Technical Notes And Manuals Volume 2021 Issue 004 2021

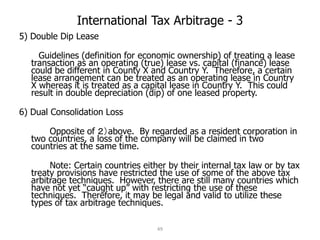

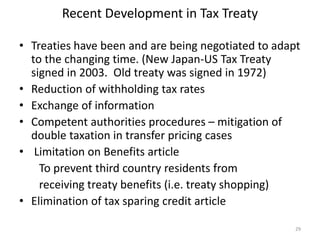

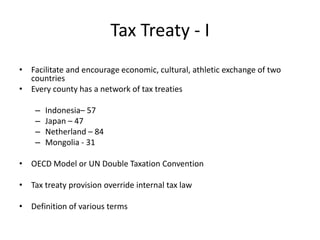

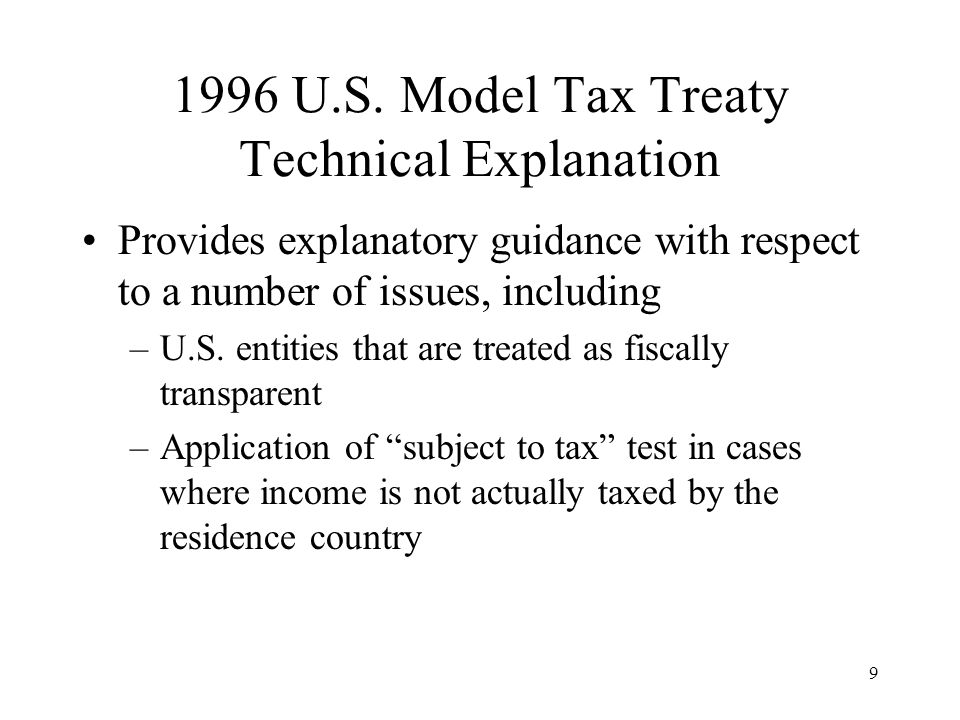

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

The Us Japan Estate Inheritance And Gift Tax Treaty Youtube

Japan United States International Income Tax Treaty Explained

Tax Treaties Hybrid Entities And Tax Planning Ppt Video Online Download